Increase efficiencies and productivity by automating core reporting tasks for medical writing.

Automate core regulatory report documents across the CTD pyramid and dramatically accelerate submission timelines.

Increase efficiencies and productivity by automating core reporting tasks for medical writing.

Automate core regulatory report documents across the CTD pyramid and dramatically accelerate submission timelines.

In 2019, we participated in the Shared Task organized by Lancaster University and Fortia Financial Solutions as part of the 2nd Financial Narrative Processing (FNP) Workshop series.

“Title Detection” was one of the two shared tasks proposed on Financial Document Structure Extraction. The objective of this shared task was to classify a given text block, that had been extracted from financial prospectuses in pdf format, as a title.

Built on a CNN-based architecture, our best performing model scored 97.16 %, a percent less than the winning model.

Some of the improvement measures, such as hyper-parameter tuning, weight initialization, are discussed in our paper.

Data states facts but it provides little to no knowledge regarding how these facts are materialized. While financial analysis depends heavily on factual data, the ability to explain data variability is what makes the analysis effective.

The challenges posed by financial narratives are at the heart of a lot of discussions within the finance industry. As an NLG provider with a specialized focus on Financial Reporting, Yseop is often faced with the need to deliver a relevant mapping of events, indicators, and facts, making causality one of our main research topics.

Our contribution to the FinTOC 2019 shared task provided us with a wonderful opportunity to meet with Mahmoud El-Haj who chair organized the FNP 2019 workshop at NoDaLiDa Conference in Turku, Finland. Mahmoud and Paul Rayson, from Lancaster University, started the Financial Narrative Processing (FNP) workshop series, with the first edition of the workshop being held at LREC 2018 in Miyazaki, Japan.

They kindly accepted to associate us with the 2020 occurrence of the upcoming FNP workshops to be held at the 28th International Conference on Computational Linguistics (COLING’2020), Barcelona, Spain on 12 December 2020.

Yseop will be organizing the Financial Document Causality Detection Task and release the FinCausal Dataset associated with that task.

This Shared Task aims to develop an ability to explain, from external sources, the reasons why a transformation occurs in the financial landscape, as a preamble to generating accurate and meaningful financial narrative summaries.

Its goal is to evaluate which events or which chain of events can cause a financial object to be modified or an event to occur, regarding a given external context. This context is available in the financial news, but due to the high volatility of such information, mapping an external cause to a given consequence is not trivial.

The task dataset was extracted from different 2019 financial news kindly provided by our partner Qwam Content Intelligence, and additional SEC data from the Edgar Database.

Details on the annotation scheme and purpose of the tasks are available in our shared paper.

Although fact-checking is a major and vital research area today, our task will not discuss the veracity of the state of affairs considered in the annotation. We will release a precise description of the semantics underlying our annotations of the dataset so that it might be appropriated by the research community.

Our Shared Task will be split into two sub-tasks:

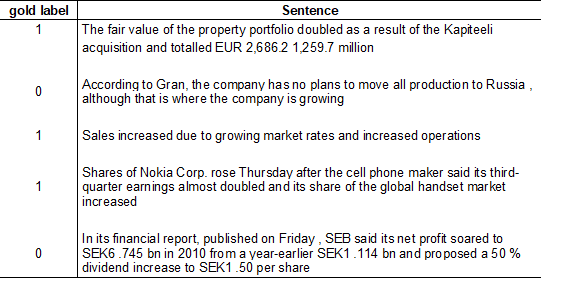

This task is a binary classification task. The goal of this subtask is to filter sentences which display causal meanings (1) from the sentences that are noise in regard to causality (0).

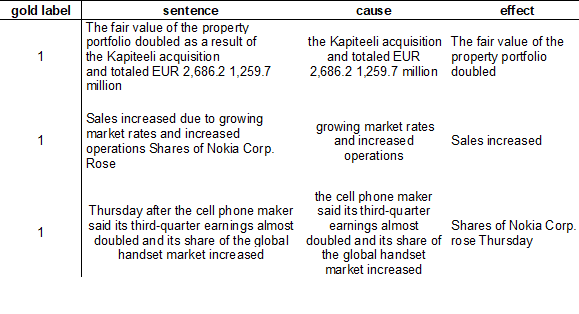

This task is a relation detection task. The aim is to identify, in a causal sentence or text block, the causal elements and the consequential ones.

At Yseop, we endeavor to keep abreast of technology and create the perfect synergy across AI disciplines to unleash the full potential of intelligent automation.

Our Innovation Team Lab is a blended team of data scientists, linguists, NLG, NLU, and Machine Learning experts, dedicated to exploring technology developments and working on bringing the most promising, from ideation to market.